SafePal Earn is a yield aggregator built within the SafePal app to allow users to earn higher yields on their crypto assets. It allows users to stake crypto assets into DeFi mining pools and earn passive income from those pools, all done natively within the wallet without actually going to third-party DApps. In the first phase, SafePal Earn has integrated some of the most popular pools from PancakeSwap and ApeSwap, while more blockchains and protocols will be gradually integrated in the future.

Convenience of working with DeFi platforms after the emergence of Safe Bridge

For a crypto beginner, learning to work with DeFi is usually long and complicated. Using wallets and blockchain knowledge, learning to use DeFi is undoubtedly an exhausting journey. To complete the cycle of using DeFi, crypto beginners usually need to go through at least 11 steps to be able to benefit from smart contracts, although there are risks in between that we will talk about.

Safe Paul Earn is designed to meet these needs.

SafePal Earn is a simple yield aggregator platform that is built within the SafePal app. It combines some of the most popular DeFi pools into a clear, concise, and user-friendly interface. With SafePal Earn, users can stake crypto assets in just a few simple steps and earn passive income from those pools. This can be done all natively within the wallet, without having to open third-party DApps or hold tokens to pay for network fees in order to compound their pools. SafePal Earn provides a convenient way for users to safely navigate the world of DeFi and easily manage their crypto assets.

A faster, safer and more native DeFi experience

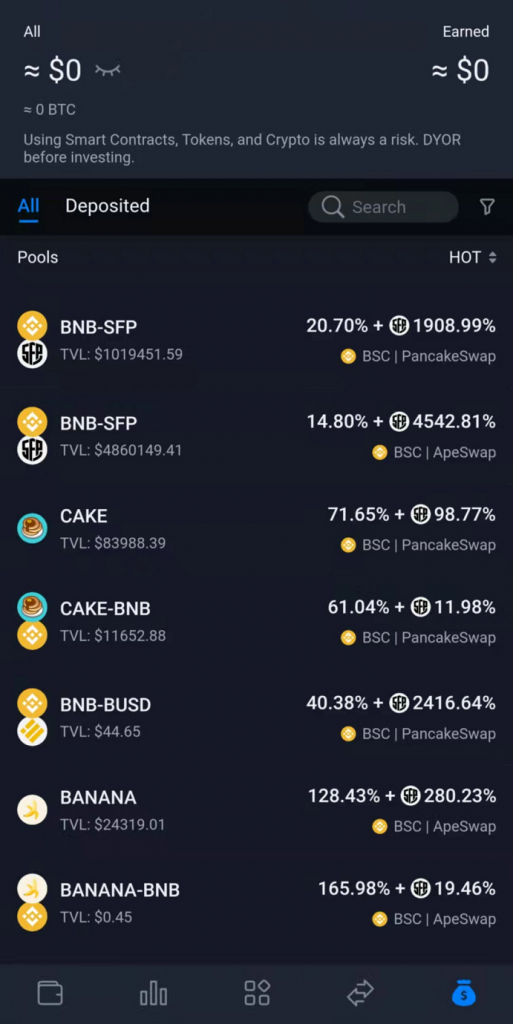

SafePal Earn is a yield aggregator platform that is built natively within the SafePal app. With a few clicks and a signature process, users can stake crypto into some of the most popular liquidity pools from integrated smart contracts. Currently, SafePal supports PancakeSwap and ApeSwap.

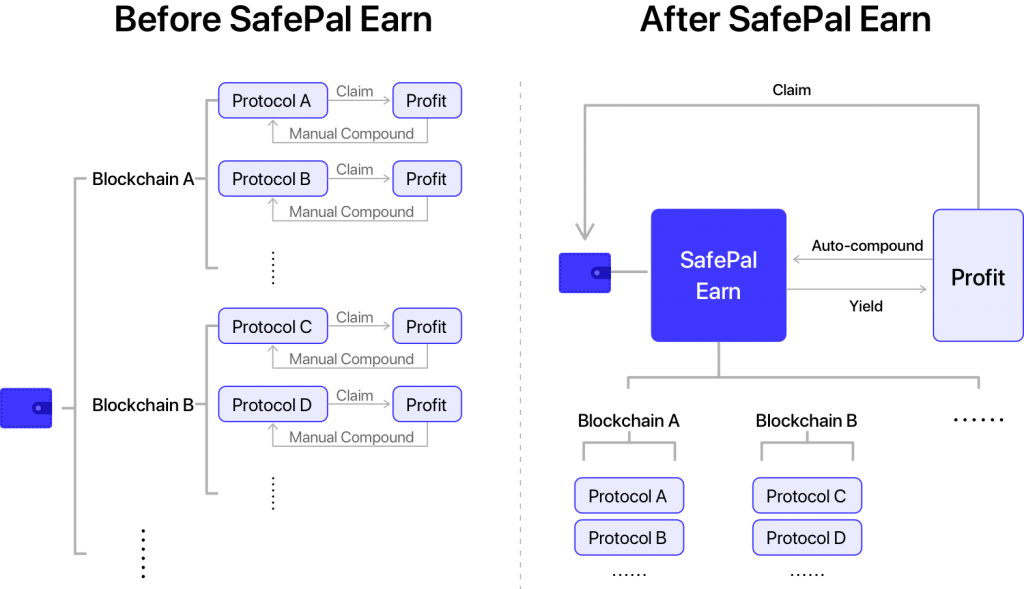

As you can see in the figure above, SafePal earn is a comprehensive platform where you don’t need to experience the complexities of working with different blockchains to work in the DeFi world, and there may be risks in this tortuous process. By combining different blockchains, Safepal Earn allows you to easily work with pools.

Carefully selected DeFi protocols that save you time and energy

A DeFi protocol goes through thorough evaluation and in-depth development before being implemented in SafePal Earn. Various parameters are adopted to estimate whether a DeFi protocol meets SafePal Earn requirements, including security audit, APY, TVL, setup time, and more. This feature helps users in the decision-making process by narrowing down DeFi options to a handful of carefully vetted options.

Maximize returns on your crypto assets

SafePal Earn adopts an automatic compounding strategy to increase the amount of your deposited token by combining yield farm reward tokens into the initially deposited asset. The higher the TVL in a pool, the higher the frequency of automatic compounding SafePal Earn will run. This strategy saves network costs helps increase agricultural productivity and maximizes APY on deposited assets. Finally, users will no longer need to manually combine their pools and bear the additional costs of manual composition.

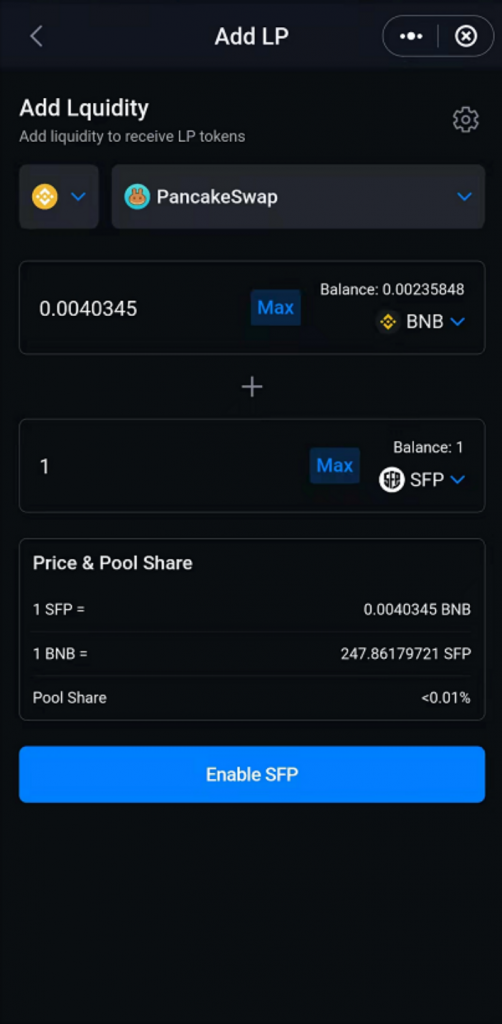

Create LP wallet effortlessly and without leaving the interface.

If a user wants to put assets into a pool but does not hold any LP tokens for that pool, the user can jump to the LP Center DApp with one click to generate LP tokens easily. Currently, LP Center supports LP token creation in BSC. More blockchains and protocols will be added later. Here is a tutorial on how to create LP tokens in the SafePal app.

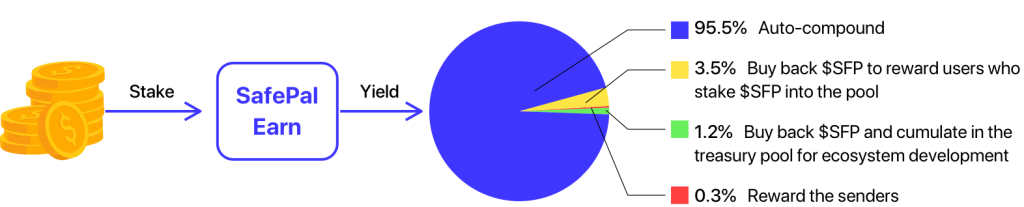

SFP reward incentive mechanism

SafePal Earn integrates SafePal’s native utility token, $SFP, at the core of all its implemented protocols. The platform’s revenue is generated from a small percentage of the total pool profits. A portion of the platform’s earnings are then converted to $SFP and distributed to those who stake $SFP in SafePal Earn. By staking SFP, you can earn higher APYs on your investments. The staking limit for SFP in a pool is equivalent to 10% of the value of your staked LP/Tokens

In the video below, decentralized platforms are discussed in full.

Safe Paul company warnings about working on these platforms

Danger warning

Investing in digital currencies and using smart contracts is subject to high market risk. Please invest and do your research carefully. SafePal will do its best to select high-quality protocols for SafePal Earn, but will not be responsible for your investment losses.

The provision of SafePal Earn services does not constitute investment advice, financial advice, business advice, or any other kind of advice and you should not treat the content of the article as such. SafePal does not recommend that you buy, sell, or hold any digital currency. Before making any investment decisions, do the necessary investigations and consult with your financial advisor at Ledger Nano.

Non-Approval of Third Party Partners

The appearance of a third party on SafePal Earn does not constitute an endorsement, guarantee, warranty or recommendation by SafePal. Do your due diligence before deciding to invest in third-party projects or use third-party services.